Weekly Mortgage Watch – August 26, 2018

First Team’s Weekly Mortgage Watch (August 26th, 2018) This Week Highlights The Following Updates:

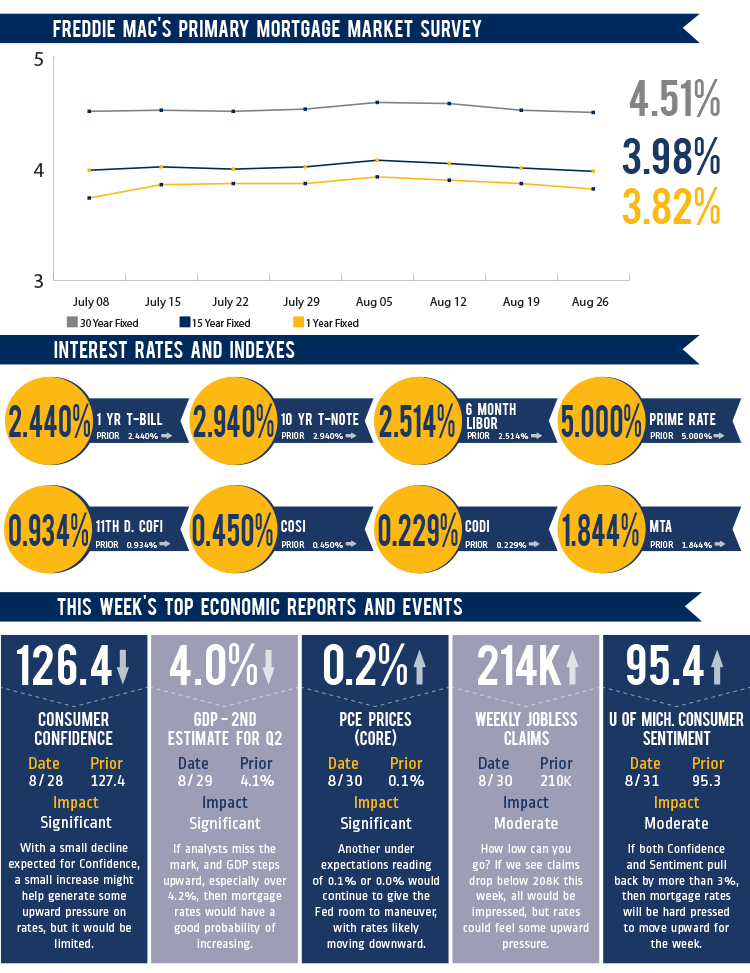

- Mortgage rates managed to mostly hold steady last week, with a little retreat brought on by the Fed. The meeting minutes did not reveal any real bias for the Fed to change its current course.

- Without some significant intervening factor, the Fed will likely raise its interest rates next month and then again in December.

- Inflationary pressures continue, as they have for some time, to give the Fed plenty of room to operate. While we saw some acceleration in pressure in the last year, it seems to be holding steady.

- Housing news was not as positive as many would have liked with both Existing and New Home Sales stepping downward. While some have pointed to tight underwriting, the majority of the constraint comes from tight inventories, increasing prices, and limited wage growth.

- This week wraps up the month with GDP and PCE Price data. If GDP remains unchanged or only moves a tenth of a point, then rates have a strong likelihood of continuing to remain flat. PCE Prices could influence that, but only if we got a big surprise of unexpected inflationary pressure.

Millennials Clean Up Your Financial Habits

In an evaluation of 60 million millennials financial habits, Experian discovered that only 39% of this age group, who did not have a mortgage, would have a prime or better credit score. Currently, only about 15% of US millennials have a mortgage. The study indicated that many of those without a mortgage often had early life financial mistakes. For many, improving their credit scores would be as simple as building a history of on-time payments and better credit balances.

![Weekly Mortgage Watch – August 26, 2018 [Infographic]](https://assets.agentfire3.com/uploads/sites/2/2018/08/Weekly-Mortgage-Watch-August-26-2018-1080x675.png)

Have A Question Not Answered Here? Ask Us!