Weekly Mortgage Watch – October 28, 2018 [Infographic]

First Team’s Weekly Mortgage Watch (October 28th, 2018) This Week Highlights the Following Updates:

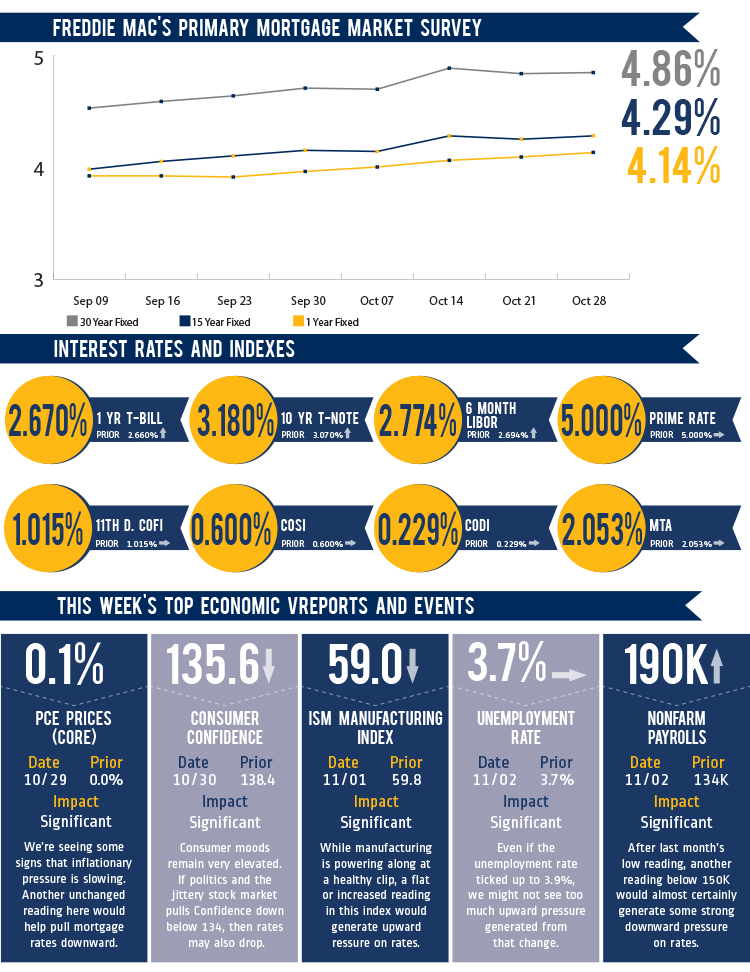

- As the stock market extended its correction last week with money flowing into bonds, mortgage interest rates remained stubbornly unchanged until slipping toward the end of the week.

- The biggest economic news was the first estimate for 3rd quarter GDP, coming in at 3.5%. Sales of new homes continued the trend of softening data for the housing market.

- Overall, the economy remains in good shape, but the level of uncertainty regarding how much steam remains in this economic cycle has some analysts expressing some concerns about how reducing accommodative monetary policy, increasing government borrowing, and increasing tariffs will impact the overall US economy.

- This week is loaded with important economic data with expectations mostly pointing toward some downward trends for most indicators.

- If all of the week’s data comes in above expectations, then we could see rates moving upward.

- However, if even a few of the important indicators, especially non-farm payrolls, come in under expectations, then rates might start trending slowly downward.

Move over FICO, Get Ready for UltraFICO?

FICO, Experian, and Finicity announced a new pilot project that factors a borrower’s banking activity into a new credit score called UltraFICO. The new score hopes to give a boost to some borrowers, especially on the lower end of the credit score spectrum. The score uses traditional elements of credit scores but also takes into account cash management concepts, such as how long bank accounts have been open and whether the borrower has a pattern of saving money.

![Weekly Mortgage Watch – October 28, 2018 [Infographic]](https://assets.agentfire3.com/uploads/sites/2/2018/10/Weekly-Mortgage-Watch-October-28-2018-1080x675.png)